I did. But I haven't seen or heard of any big bank runs with any of the big boys. Yet. We'll see what happens this week.

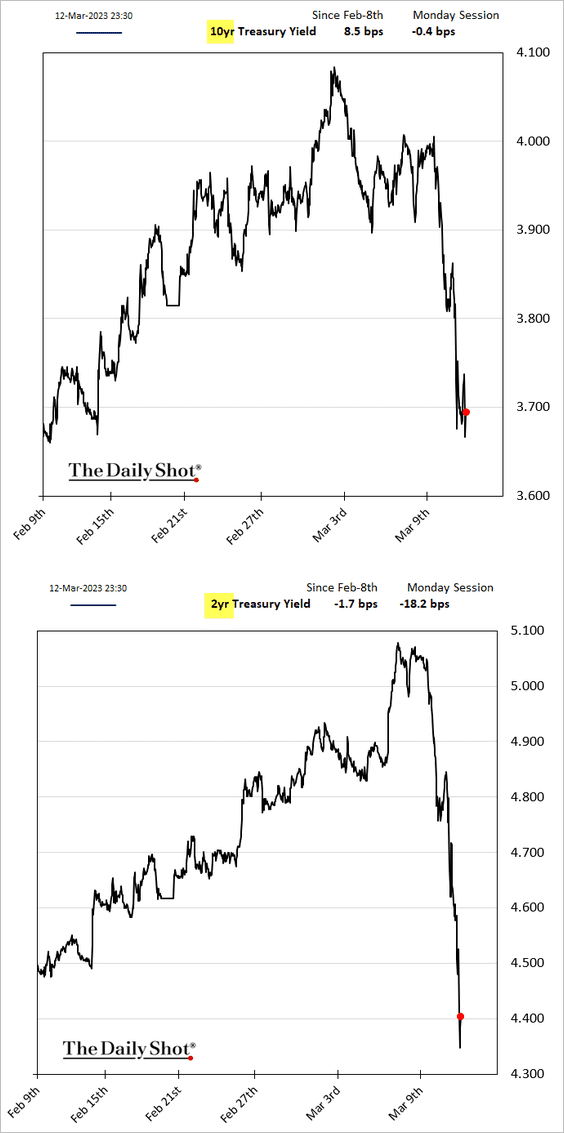

This is what a run looks like. Cash is coming out of banks and going into 2 year USTs. This is a MASSIVE move. It amounts to trillions of $.