It seems the bank is done. All deposits guaranteed by the FDIC. No taxpayer money… well except the fees that fdic is going to charge the other banks (the taxpayers) to fund this.Unless I’m misreading, they’re guaranteeing all deposits.

Bank will still be on the hook but they’ll just file bankruptcy I’m sure.

Sent from my iPhone using svtperformance.com

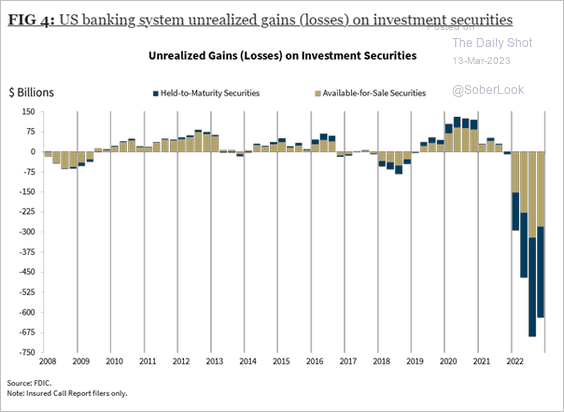

Doesn’t seem to me like this is a real big loss issue as the assets are there, just currently valued as shit due to the interest rates. The big issue long term seems to be the erosion of the laws of capitalism as is always the case. I am certainly no expert.