Sorry, point was we thought subprime was contained in 2007. The shitstorm was only beginning.

Today's victims

Rgr that. We may look back in a couple yrs and say this was the beginning.

Sent from my iPhone using the svtperformance.com mobile app

Sorry, point was we thought subprime was contained in 2007. The shitstorm was only beginning.

Today's victims

"Its not systemic"

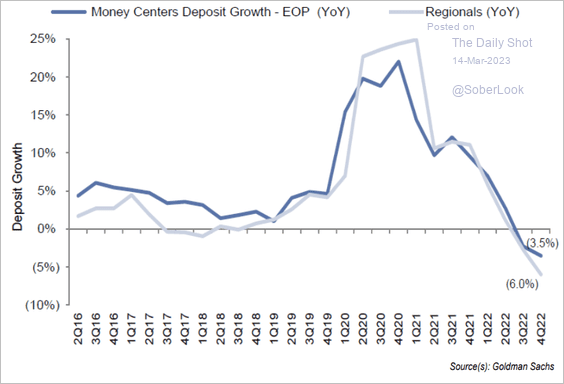

Deposits:

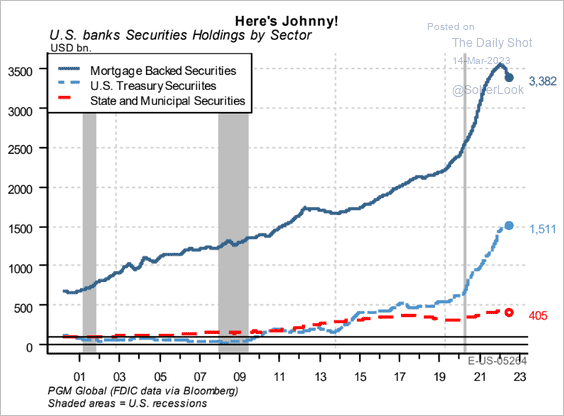

Assets:

I know you don’t like him and I respect you.

I know you don’t like him and I respect you.

But no one can argue that he was right about EVERYTHING that matters.

Maybe more go woke, get bailed out category. Well except for the morons that were investing in and actually running the bank. Even Dems knew that shit wouldn't fly this time.Does this fall in the go woke and go broke category?

Does this fall in the go woke and go broke category?

Honestly, most of this is way over my head. I tried to read/skim this whole thread, and you might of explained it already. But did that hole come from loaning to woke tech companies?No. They had a hole in their balance sheet as does every other bank right now.

it did notHonestly, most of this is way over my head. I tried to read/skim this whole thread, and you might of explained it already. But did that hole come from loaning to woke tech companies?

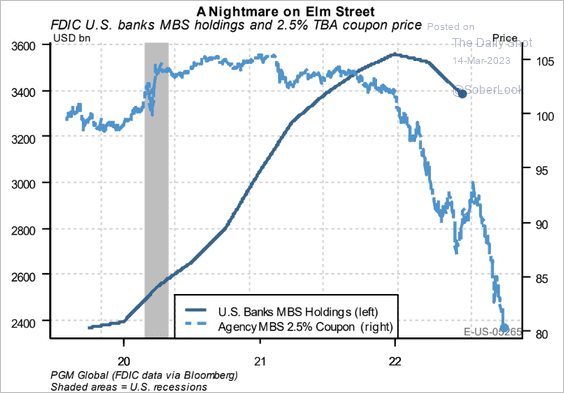

Not really. They just took in short term deposits and invested them in long term securities - unfortunately the securities' value went to shit because interest rates were raised. So you basically have a security that pays 2% for the long term when interest rates are 5+% so the security isn't worth much at present time. Blah blah blah.Honestly, most of this is way over my head. I tried to read/skim this whole thread, and you might of explained it already. But did that hole come from loaning to woke tech companies?

Not really. They just took in short term deposits and invested them in long term securities - unfortunately the securities' value went to shit because interest rates were raised. So you basically have a security that pays 2% for the long term when interest rates are 5+% so the security isn't worth much at present time. Blah blah blah.

Hey Klaus - any idea what the actual value of the assets are at present day vs. the deposits? Don't think I ever saw that anywhere.

Yeah. Screw the equity and bonds. I was just wondering if nothing was done and they liquidated everything for the depositors, how much of a haircut would the depositors have to take. IMO they should be the last ones, but should take some type of haircut due to their lack of due diligence on where they keep their money.Significantly negative although I do not know by how much. SVB was insolvent in November and it has only gotten worse.

Equity is wiped out and bonds are trading at 30 cents.

Significantly negative although I do not know by how much. SVB was insolvent in November and it has only gotten worse.

Equity is wiped out and bonds are trading at 30 cents.

Apparently there were buyers for the bank but gov had a white list of appropriate buyers?They must have been wildly insolvent where no financer would touch them. Id imagine it's been a full-court press for the last year to find PE or some mega donor who would fund long term until bonds (and everything else) recovers.

Apparently there were buyers for the bank but gov had a white list of appropriate buyers?

Significantly negative although I do not know by how much. SVB was insolvent in November and it has only gotten worse.

Equity is wiped out and bonds are trading at 30 cents.

So you can trade bonds like an equity?

Let’s say you buy a 30yr. You can sell anytime before the maturity date?

Maturity date=guaranteed time period of initial interest rate?

I don’t know shit about bonds.

Sent from my iPhone using the svtperformance.com mobile app

So you can trade bonds like an equity?

Let’s say you buy a 30yr. You can sell anytime before the maturity date?

Maturity date=guaranteed time period of initial interest rate?

I don’t know shit about bonds.

Sent from my iPhone using the svtperformance.com mobile app

I just hope some day you visit Naples and we can grab some drinks and a meal.Sorry I think you missed it. I am clowning @JAJ because Trump did not actually do anything.

He did not bother to grasp the article that Trumps action was merely symbolic. He signed an order to "investigate" changing a rule which means bubkis.

Leftist Canadians posting articles from British leftist rags do not seem to understand that Congress not the president make rules in the US.

I just hope some day you visit Naples and we can grab some drinks and a meal.