Surprised no bounce off the drop for Meta.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SVTP stock pick thread.

- Thread starter STAMPEDE3

- Start date

It’ll never happen. Too many people addicted to having to know what everyone else is doing.

When you only look at family posts and keep up with your weather air force buddies, in my case, it makes it tough to delete. Still, I have thought hard about deleting it regardless.

The Feds are really scared of the Friday January jobs report.

Took a chance with some SNAP since it was down so much before it had even released earnings, paying off well so far.

Ouch!

Meta Platforms spent $20B during the quarter on buybacks - for nothing

FB -0.28%Feb. 05, 2022 4:20 PM ET184 CommentsIn the metaverse, no one can hear you scream.

That shriek shareholders heard this past week was not only caused by the deep dive in Meta Platforms' (NASDAQ:FB) market cap after it reported poor earnings and guidance, but an ear-piercing sound as a result of an elevated buyback that left some bewildered.

While the more than $220 billion decline may go down as the largest drop in value in stock market history, market capitalizations fluctuate. However, the company may have made an even more egregious error that has largely gone unnoticed: spending nearly $20 billion in actual cash on share repurchases during the fourth quarter of last year that provided little, if any value.

These three questions need a 'yes' for bulls to keep charging, BofA says

SPY +0.47%Feb. 07, 2022 6:41 AM ET4 CommentsThe Fed is hiking into overvalued global credit and U.S. stock markets and there is potential for a crash this year, according to BofA.

Chief Investment Strategist Josh Hartnett and team wrote in the latest Flow Show note that "almost all of 10 hiking cycles in past 50 years started with trailing S&P 500 (SP500) (NYSEARCA:SPY) PE of ~16x."

The exceptions are 1999 with P/E of 25.7x and now at 22.4x.

For stocks, the "bull case requires affirmative to 3 biggest investment questions of 2022," Hartnett said.

- Will the Fed engineer a soft landing?

- Are we early-cycle in the investment cycle?

- Will the Fed blink?

But in his view the low Fed terminal rate is a sign the markets anticipation late-cycle valuation that "that will be corrected via crash & the Fed blinks."

Hartnett and team are short tech, credit and private equity as the era of QE is over.

They are long volatility, high quality and defensives on tighter financial conditions and oil, energy and real assets on inflation. They are also long EAFE and EM banks on global reoping and rate hikes and China, Asian and EM credit on distressed yields, while long a barbell of distressed and defensive assets.

"We believe cash, volatility, commodities, EM to outperform credit, stocks & private equity in 2022."

The major investment houses are in serious CYA mode this morning!

Kameleon007/iStock via Getty Images

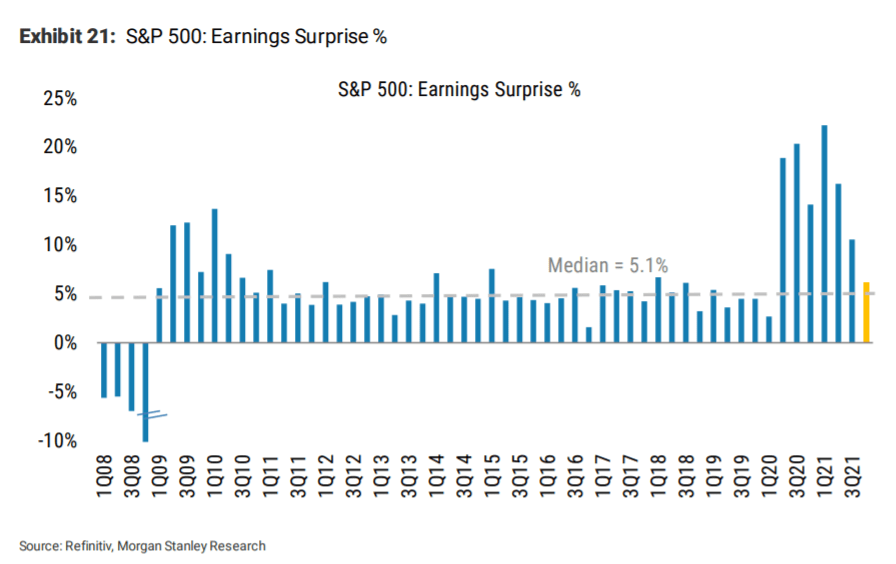

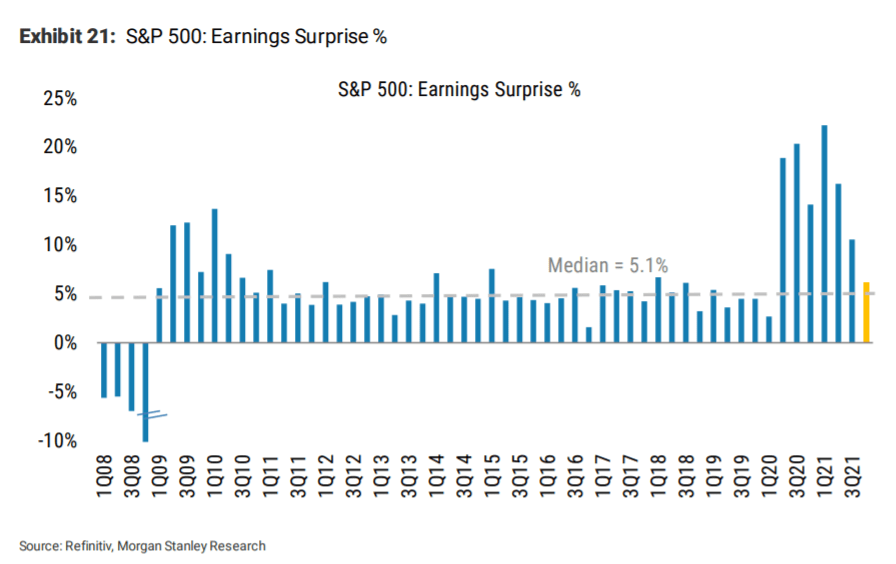

It is time for investors to double up on defensive positioning as Wall Street faces earnings payback, Morgan Stanley says.

"We have longheld the view that payback was coming in 1H2022 as the extraordinary fiscal stimulus faded, monetary policy tightened and supply caught up with demand in many end markets," chief equity strategist Mike Wilson wrote in a note Monday.

"Over the past few weeks several leading companies that weren't supposed to see this payback have disappointed with weaker than expected guidance," Wilson said. "These stocks were punished severely and we think there may be even more disappointment to come as 1Q turns out to be weaker than expected for consumption."

"Consumer confidence remains in the tank due to higher prices with our recent Alpha Wise survey suggesting Consumers across the income spectrum are expecting to spend more on staples categories over the next 6 months vs the last 6 months. Spending on durables, consumer electronics, and travel/leisure is expected to decline for lower income cohorts in particular."

Morgan Stanley has favored defensive sectors since November.

"With last week's modest rally in cyclicals relative to defensives we think it's a good time to double up on this particular pair, especially with the further fall in PMIs and flattening of the rate curves. Other pairs worth consideration are defensives over inflation plays and low levered companies over highly levered ones," Wilson said.

"The overall earnings surprise rate for companies in the S&P 500 (SP500) (NYSEARCA:SPY) stands at 6.1% - just above the long term median of 5%," he added. "This represents a significant decline from the past 6 quarters when beats ranged from 11% - 22%. Companies that are beating estimates this quarter are doing so by a much lower margin."

BofA says these three questions need a "yes" for stocks to move higher.

Morgan Stanley says investors are too optimistic, warns of earnings 'payback'

Feb. 07, 2022 7:41 AM ETSPDR S&P 500 Trust ETF (SPY)SP500By: Kim Khan, SA News Editor

Kameleon007/iStock via Getty Images

It is time for investors to double up on defensive positioning as Wall Street faces earnings payback, Morgan Stanley says.

"We have longheld the view that payback was coming in 1H2022 as the extraordinary fiscal stimulus faded, monetary policy tightened and supply caught up with demand in many end markets," chief equity strategist Mike Wilson wrote in a note Monday.

"Over the past few weeks several leading companies that weren't supposed to see this payback have disappointed with weaker than expected guidance," Wilson said. "These stocks were punished severely and we think there may be even more disappointment to come as 1Q turns out to be weaker than expected for consumption."

"Consumer confidence remains in the tank due to higher prices with our recent Alpha Wise survey suggesting Consumers across the income spectrum are expecting to spend more on staples categories over the next 6 months vs the last 6 months. Spending on durables, consumer electronics, and travel/leisure is expected to decline for lower income cohorts in particular."

Morgan Stanley has favored defensive sectors since November.

"With last week's modest rally in cyclicals relative to defensives we think it's a good time to double up on this particular pair, especially with the further fall in PMIs and flattening of the rate curves. Other pairs worth consideration are defensives over inflation plays and low levered companies over highly levered ones," Wilson said.

"The overall earnings surprise rate for companies in the S&P 500 (SP500) (NYSEARCA:SPY) stands at 6.1% - just above the long term median of 5%," he added. "This represents a significant decline from the past 6 quarters when beats ranged from 11% - 22%. Companies that are beating estimates this quarter are doing so by a much lower margin."

BofA says these three questions need a "yes" for stocks to move higher.

Feb 14 $CENN valuation

This day will tell me how much I’ll be dumping you to the Amazon split

This day will tell me how much I’ll be dumping you to the Amazon split

i really wish they'd hustle up with thatFeb 14 $CENN valuation

This day will tell me how much I’ll be dumping you to the Amazon split

I'm ready to dump it lol... Just take my hit and try to get it back slowly.Feb 14 $CENN valuation

This day will tell me how much I’ll be dumping you to the Amazon split

I'm ready to dump it lol... Just take my hit and try to get it back slowly.

I almost did that when Doge got 14.2, would have made 17% already..

Depending on Feb 14.. is what I’ll do…

It’ll either be a brutal 1-5 billion valuation.. or for all we know could be 25 billion…

Given all their patents.. the thousands of vehicles they’ve released… their I chassis software… who knows…

An over 10 billion valuation would put me in the money IF the stock value follows.

They’ve been so slow on PR it’s unbelievable…

Unfortunately, it's believable lol. If it's over 1B I'll be very surprised.I almost did that when Doge got 14.2, would have made 17% already..

Depending on Feb 14.. is what I’ll do…

It’ll either be a brutal 1-5 billion valuation.. or for all we know could be 25 billion…

Given all their patents.. the thousands of vehicles they’ve released… their I chassis software… who knows…

An over 10 billion valuation would put me in the money IF the stock value follows.

They’ve been so slow on PR it’s unbelievable…

Unfortunately, it's believable lol. If it's over 1B I'll be very surprised.

In 18 or 19.. they were rumored to be valued above 3 billion. Forgot where I saw that though.

One would think with their growth it would be dramatically higher

But I’m not holding my breath at all..

I’m still sticking with though.. if Rivian was somehow worth what people claimed…

How is this not worth 1/10th with thousands more vehicles sold and a world wide imprint

In 18 or 19.. they were rumored to be valued above 3 billion. Forgot where I saw that though.

One would think with their growth it would be dramatically higher

But I’m not holding my breath at all..

I’m still sticking with though.. if Rivian was somehow worth what people claimed…

How is this not worth 1/10th with thousands more vehicles sold and a world wide imprint

The people that bought the Rivian IPO and held aren't too happy.

The people that bought the Rivian IPO and held aren't too happy.

Oh absolutely not. Down 45%

But that’s not before it shot 60% lol.

Yikes on that cenn chart, looks like another R/S incoming.

Crazy thing is it has a 200%I.V. but you can buy Flippin 100 lots for 5 bucks up and down the chain.

I can't make sense how the I.V. is so high with zero upside priced... must've been a ton of puts rolling it lower, or deep ITM call sales crushing it down.

Maybe there was a warrant structure but I didn't see any off hand.. that would make alot of sense too.

Crazy thing is it has a 200%I.V. but you can buy Flippin 100 lots for 5 bucks up and down the chain.

I can't make sense how the I.V. is so high with zero upside priced... must've been a ton of puts rolling it lower, or deep ITM call sales crushing it down.

Maybe there was a warrant structure but I didn't see any off hand.. that would make alot of sense too.

Yikes on that cenn chart, looks like another R/S incoming.

Crazy thing is it has a 200%I.V. but you can buy Flippin 100 lots for 5 bucks up and down the chain.

I can't make sense how the I.V. is so high with zero upside priced... must've been a ton of puts rolling it lower, or deep ITM call sales crushing it down.

Maybe there was a warrant structure but I didn't see any off hand.. that would make alot of sense too.

They are one of the “ larger “ Ev companies too..

I’m wondering if it’s relation to NAKD still hurts it. Who knows

Oh absolutely not. Down 45%

But that’s not before it shot 60% lol.

Money was made, no doubt.

Life isn't easy being an EV startup. How bad does it have to be getting shit that the people responsible for getting said shit say adios?

Nikola swings lower on report supple chain execs have left

NKLA +2.32%Now!- Nikola Corporation swung to a loss in Tuesday trading after Electrek reported that the company has lost almost its entire supply chain leadership over the last few months.

- In addition, sources tell the website that the company has a temporary hiring freeze in play.

- Nikola (NASDAQ:NKLA) has not responded to the report.

- Shares of Nikola (NKLA) fell 0.80% Tuesday after being up more than 1.50%. The EV stock is down about 70% from the 52-week high.

Inflation 7.5% and the Fed is still injecting.

Users who are viewing this thread

Total: 72 (members: 4, guests: 68)