You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SVTP stock pick thread.

- Thread starter STAMPEDE3

- Start date

Inflation is permanent and will weigh on stock-market returns for years, says the head of world's largest wealth fund

[email protected] (Harry Robertson) - 4h agoView Profile

- Inflation is permanent and will depress stock-market returns for years, the head of world's largest wealth fund has said.

- The chief of Norway's $1.3 trillion oil fund told the FT that inflation is rising in more and more places.

- Nicolai Tangen said stock and bond investors could be set for a long period of low returns.

High inflation is "permanent" and will weigh on returns in stock and bond markets for years to come, the head of the world's largest sovereign wealth fund has warned.Nicolai Tangen, chief executive of Norway's $1.3 trillion fund, said he thinks inflation is rising "across the board, in more and more places," speaking in an interview with the Financial Times published Sunday."You saw Ikea increasing prices by 9 per cent, you have seen food prices going up, continued very high freight rates, trucking rates, metals, commodities, energy, gas," he said. "We're seeing signs on wages as well."Norway's fund is a huge player in financial markets, holding the equivalent of 1.4% of all of the world's listed companies. It's active in 73 countries, and it invests in stocks, bonds, real estate and renewable energy infrastructure.Tangen said he is "the team leader for team permanent" – those who believe strong price rises are here to stay, as opposed to those who believe the surge in inflation is transient."How will it pan out? It hits bonds and shares at the same time … for the next few years, it will hit both," he told the FT.

The benchmark S&P 500 stock index is down 7% for the year, with tech companies the biggest fallers. The yield on the key 10-year US Treasury note, which moves inversely to the price, has risen from around 1.63% at the start of the year to 1.784% Monday.

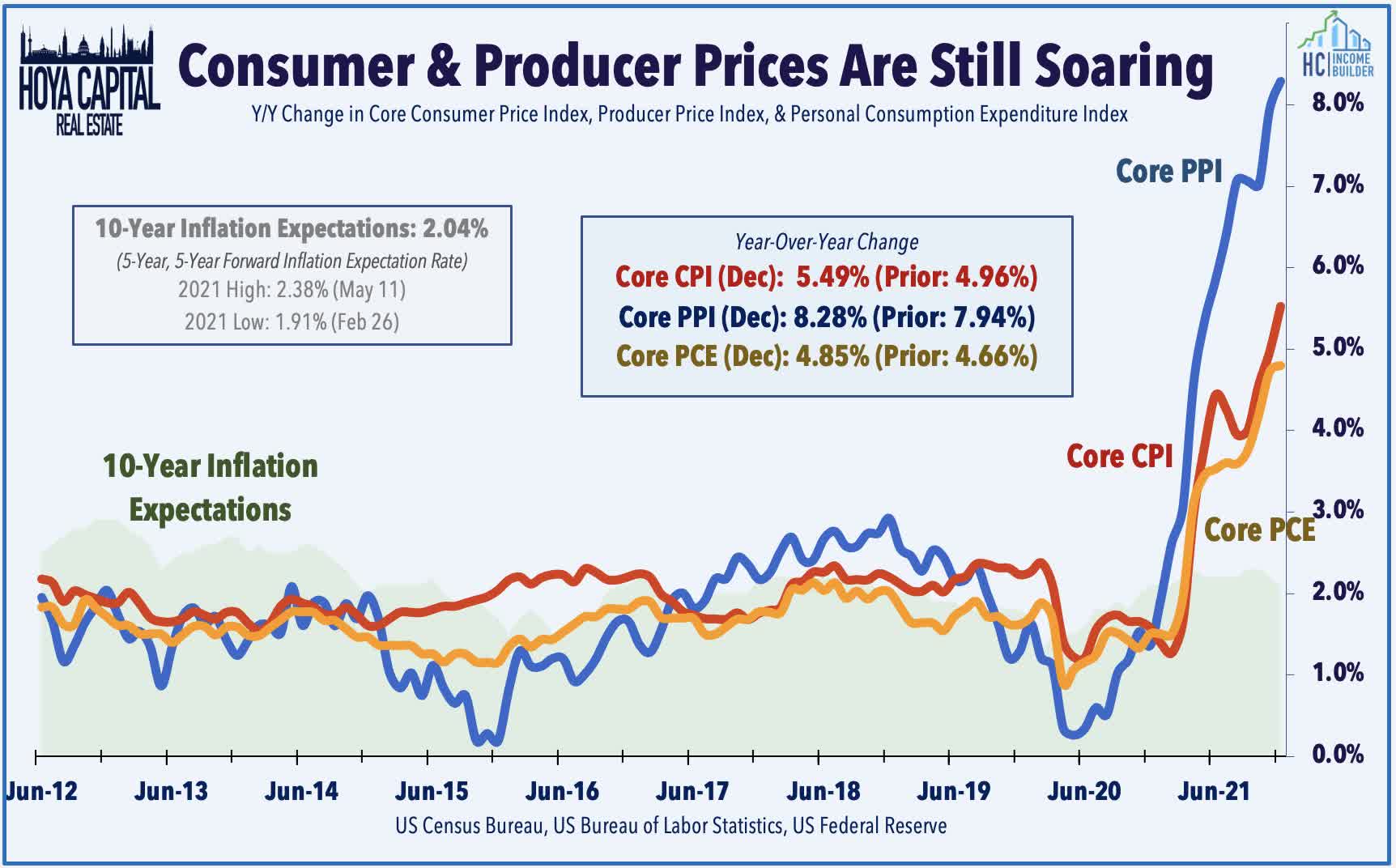

US consumer price index inflation came in at a 39-year high of 7% year-on-year in December. Markets now expect the Fed to hike interest rates five times in 2022 as it tries to get prices under control.

Read more: 'Goldilocks just jumped out of the window.' A strategist at a $4 billion hedge fund says Fed rate hikes will put risk assets in their most fragile state since the 2008 crisis — and shares 3 ways to position for a prolonged correction

"With extremely low interest rates and a very high stock market, and with increasing — and in some places, accelerating — inflation, we could see a long period of time with low returns," Tangen told the FT.

However, many investors believe central banks will succeed in getting inflation under control, although some worry that they may have to induce recessions.

The Bank of England is widely expected to hike interest rates for the second meeting in a row on Thursday, as it grapples with strong price rises.

A closely watched US inflation expectations gauge, the 10-year breakeven rate, stood at 2.44% Friday. That suggests markets think inflation will average 2.44% over the coming decade, well below December's 7% rate but above the Fed's 2% target.

Read the original article on Business Insider

Join the conversation

149

Attachments

Fear porn is out of control.

He manages over a trillion dollars.

He runs a hedge... they don't even target market perform

He's saying the right thing though, get that on record so you don't look too bad when you can't market perform

Running long/short books only aim for preservation.

Smart guy I'm sure.. just underperforms.

He only did 14% last year... almost HALF of the S&P... again... fear porn.

He's saying the right thing though, get that on record so you don't look too bad when you can't market perform

Running long/short books only aim for preservation.

Smart guy I'm sure.. just underperforms.

He only did 14% last year... almost HALF of the S&P... again... fear porn.

He runs a hedge... they don't even target market perform

He's saying the right thing though, get that on record so you don't look too bad when you can't market perform

Running long/short books only aim for preservation.

Smart guy I'm sure.. just underperforms.

He only did 14% last year... almost HALF of the S&P... again... fear porn.

To be fair, preservation of assets is probably their number 1 investing criteria. If you keep compounding a trillion at 14% every year, life is good for Norway.

Moderna gets FDA approval. Immediate 5% jump

Nice to see things coming back as expected, it just may take a while (few months) to get there.

Wall Street divided on pace of Fed rate hikes in 2022

Feb. 01, 2022 6:04 AM ET2 CommentsMany are still trying to size up the Fed's monetary policy for 2022 as the market heads into February. What we know so far is the central bank will begin hiking rates in March, assuming that the "conditions are appropriate for doing so," but it's anyone's guess how aggressive the FOMC will be after that as it tries to snuff out the strongest pace of inflation in decades. There is also debate over when the Fed will start reducing its balance sheet (May, June or July), though it made clear at its last meeting that pandemic-era bond-buying will come to an end next month.

How many hikes in 2022? Estimates on Wall Street now range from three rate increases all the way to seven, with the federal funds rate projected to end the year in a range of 1.25%-2.00% (the current effective floor is 0.00%–0.25%). Check out some of the forecasts below:

Barclays (3): "With reserves balances over $4T and nearly $1.5T in the [Fed's reverse repo facility,] we expect it will be difficult for short-term interest rates to trade much above the interest rate floor."

Morgan Stanley (4): "If they need to hike fast, they will. The Fed is showing urgency and being flexible."

Goldman Sachs (5): "We see a risk that the FOMC will want to take some tightening action at every meeting until the inflation picture changes."

BNP Paribas (6): "We read Fed Chair Powell's comment that this cycle is different from the previous one as an indication that the Fed's bias is for a steeper tightening than the markets and we had envisaged."

Bank of America (7): "The Fed has all but admitted that it is seriously behind the curve. With that said, the markets are doing the Fed's job of tightening financial conditions without an actual hike."

Yesterday, Esther George, president of the Kansas City Fed and voter on the FOMC, emphasized that "more aggressive action on the balance sheet could allow for a shallower path for the policy rate."

Ticker POWW looks very attractive to me right now, think I will pick some up today.

Wage inflation roars on.

Job openings 10.925M in December

TRVI +11.34%Feb. 01, 2022 10:05 AM ET1 Comment- 10.925M December Job Openings vs. 10.3M consensus and 10.775M prior (revised from 10.562).

- Job openings rate 6.8% vs. 6.6% prior.

- Quits rate was 2.9% vs. 3% prior. Job openings increased in several industries with the largest increases in accommodation and food services +133,000, information +40,000 and nondurable goods manufacturing and state and local government education +31,000 each.

Facebook misses earnings expectations causing tech stocks to plunge 20+% in post-market trading.

www.investors.com

www.investors.com

With Earnings On Tap, Snap And Pinterest Sink On Facebook News

Snap stock plunged and Pinterest fell, too, on the heels of a Facebook earnings report that missed estimates across the board.

Good. It's trash. It's crypto died and was sold off. Loosing users, lost $10B on AR and VR, advertising down. It's all bad,Facebook misses earnings expectations causing tech stocks to plunge 20+% in post-market trading.

With Earnings On Tap, Snap And Pinterest Sink On Facebook News

Snap stock plunged and Pinterest fell, too, on the heels of a Facebook earnings report that missed estimates across the board.www.investors.com

My AMD killed it yesterday, outlook and earnings are over and increased, The days of everything up is over, pick and choose your winners carefully.

Last edited:

The market is over reacting with FB.

The market is over reacting with FB.

The real question is between them and Spotify … when will

Be the Best Buy back time

The market is over reacting with FB.

They are giving competitors a chance to gain mass. Every time they shut down something like the trucker protest or conservative posters, they get closer to a tipping point of mass subscriber loss in the USA.

They are giving competitors a chance to gain mass. Every time they shut down something like the trucker protest or conservative posters, they get closer to a tipping point of mass subscriber loss in the USA.

It’ll never happen. Too many people addicted to having to know what everyone else is doing.

Very few companies have a multi billion person installed user base.

Just bad management at this point.

They really gotta monetize "marketplace"

On the rate hike post... I'm at 3 for 2022... I think we get .75 to1% fed funds.

There is just soooo much demand for yield.

On the Google split... you really want to be in well before it happens in July, people act like it shouldn't fundamentally affect price.... but it does!!

Now ALOT of the people who couldn't dream of being able to write calls or sell puts even will be able to afford to. It just creates so much notional and unlocks tremendous derivative value.

I usually don't own single names... but even I think I might grab 5 or 10 shares to be able to write contracts... YouTube alone made more money than Netflix..just Fn crazy.

Just bad management at this point.

They really gotta monetize "marketplace"

On the rate hike post... I'm at 3 for 2022... I think we get .75 to1% fed funds.

There is just soooo much demand for yield.

On the Google split... you really want to be in well before it happens in July, people act like it shouldn't fundamentally affect price.... but it does!!

Now ALOT of the people who couldn't dream of being able to write calls or sell puts even will be able to afford to. It just creates so much notional and unlocks tremendous derivative value.

I usually don't own single names... but even I think I might grab 5 or 10 shares to be able to write contracts... YouTube alone made more money than Netflix..just Fn crazy.

Last edited:

Facebook (Meta - how gay is that?) is maxed out - everyone who wants it has it. it has nowhere to go but down. This is not something to invest in, it's a dead end. TicTok is beating their ass in streaming video. Compare to Apple - always developing new chips, OS features, phones that people want. Continually maximizing for profit.

Users who are viewing this thread

Total: 18 (members: 0, guests: 18)