You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

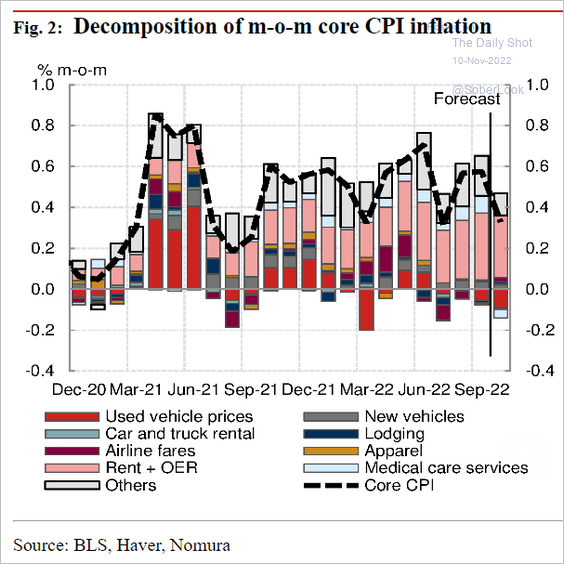

Inflation is rolling over

- Thread starter Klaus

- Start date

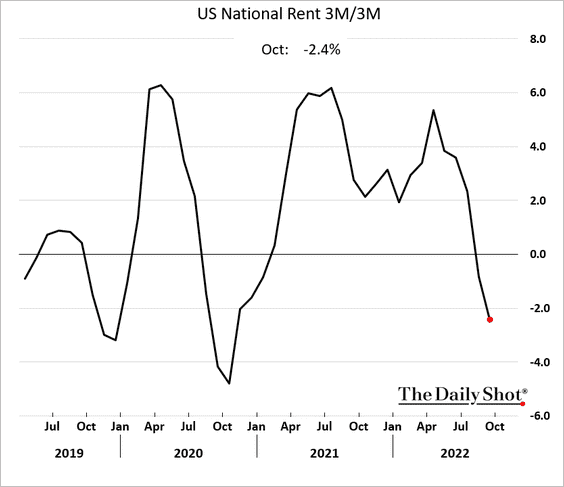

I’ve been seeing the same houses with for rent signs out front for a couple months now. Kindof surprised me but what I’m seeing locally lines up with this data.

Wouldn’t be surprised to see a 15-25% overall bump in the stock market. Moving 401k funds back out of cash but won’t take effect until market close today unfortunately.

Home sellers are still holding fast on their “values” from 6-9 months ago. Can’t wait for that to come down too.

Sent from my iPhone using svtperformance.com

Wouldn’t be surprised to see a 15-25% overall bump in the stock market. Moving 401k funds back out of cash but won’t take effect until market close today unfortunately.

Home sellers are still holding fast on their “values” from 6-9 months ago. Can’t wait for that to come down too.

Sent from my iPhone using svtperformance.com

Now if only interest rates would roll that fast as well......

I've been scouting for a 13+ used Mustang GT since August and I'm seeing the same cars with the same ridiculous prices just sit. Sellers are just in denial.

Now if only interest rates would roll that fast as well......

I think we have at least 12 months before there would be any easing, and that’s IF there is continuous signs of deflation and increased unemployment.

18-24 might be more realistic.

I wouldn’t be surprised if they still bump 50bp in Dec.

Sent from my iPhone using the svtperformance.com mobile app

@MG0h3 when are you going back from G->C?

@MG0h3 when are you going back from G->C?

Affirm. Did today.

Market was running back to 4200 without a reduction in CPI.

I think we’ll get there again easily.

Sent from my iPhone using the svtperformance.com mobile app

& Biden's answer to all of this,...................CHANGE NOTHING !!

.

.

You sure this wont be just another Dead Cat Bounce?

Yeah, I’m starting to get calls for a GT500, but I keep telling them I’m not paying over sticker….I've been scouting for a 13+ used Mustang GT since August and I'm seeing the same cars with the same ridiculous prices just sit. Sellers are just in denial.

You sure this wont be just another Dead Cat Bounce?

We can now at least contemplate an end to tightening. A recession may still be on the horizon but there is increasing clarity on rates.

Stocks in general are still uncertain but treasuries are very attractive in any scenario. Gold is probably attractive. Some of the megacap internet companies are probably attractive. Energy is maybe attractive.

Real estate is not attractive. Consumer cyclicals are not attractive. Banks are probably not attractive.

You sure this wont be just another Dead Cat Bounce?

Maybe, but the market has been bouncing off the same low and run back up @15% several times since hitting this years low. Want to say three times since Fed really started cranking rates.

The general theme after every hike was “that was the last one”. Odd because the Fed never insinuated it was, quite the opposite.

That’s why I’m confident in betting we’ll see the S&P run up past 4200 this time and maybe even hang there.

May get more sharp pullbacks and even a new low next year, but some of the bad news is already baked in. Almost all sectors/major players have revised earnings down into 23’ and the market sold on that.

Guess we’ll have to see when the poor numbers actually come out.

Sent from my iPhone using the svtperformance.com mobile app

What is the time horizon on contemplate? Supply side still seems pretty jacked and they don’t seem to be doing much about it.We can now at least contemplate an end to tightening. A recession may still be on the horizon but there is increasing clarity on rates.

Stocks in general are still uncertain but treasuries are very attractive in any scenario. Gold is probably attractive. Some of the megacap internet companies are probably attractive. Energy is maybe attractive.

Real estate is not attractive. Consumer cyclicals are not attractive. Banks are probably not attractive.

We can now at least contemplate an end to tightening. A recession may still be on the horizon but there is increasing clarity on rates.

Stocks in general are still uncertain but treasuries are very attractive in any scenario. Gold is probably attractive. Some of the megacap internet companies are probably attractive. Energy is maybe attractive.

Real estate is not attractive. Consumer cyclicals are not attractive. Banks are probably not attractive.

Don’t banks and CC companies actually do well during high interest rate periods? Sure there will be a reduction in spending but I think the interest rate % hike is steeper.

Need to look into this some more I guess.

Sent from my iPhone using the svtperformance.com mobile app

Good question. Thought I read CC balances were going through the roof. Going to be a lot of heavy balances that can’t be paid off if this thing lasts a while. That is unless Joe pays some off.Don’t banks and CC companies actually do well during high interest rate periods? Sure there will be a reduction in spending but I think the interest rate % hike is steeper.

Need to look into this some more I guess.

Sent from my iPhone using the svtperformance.com mobile app

Do you feel the Feds done raising rates? I thought I read were looking at rate hikes not stopping till 2024?We can now at least contemplate an end to tightening. A recession may still be on the horizon but there is increasing clarity on rates.

Stocks in general are still uncertain but treasuries are very attractive in any scenario. Gold is probably attractive. Some of the megacap internet companies are probably attractive. Energy is maybe attractive.

Real estate is not attractive. Consumer cyclicals are not attractive. Banks are probably not attractive.

Don’t banks and CC companies actually do well during high interest rate periods? Sure there will be a reduction in spending but I think the interest rate % hike is steeper.

Need to look into this some more I guess.

Sent from my iPhone using the svtperformance.com mobile app

Yes. Banks keep the margin between what they pay in deposits and what they lend. Delinquency hurts them though. And if rates are falling there is more competition which means they will have to charge less for their loans. Also deposits gave fallen off a cliff which means they will have to pay more for deposits too.

Do you feel the Feds done raising rates? I thought I read were looking at rate hikes not stopping till 2024?

The fed will keep raising until fed funds = inflation. so there are 2 maybe 3 hikes left.

For the market it is not about rates though. It is about rate expectations. A 7% CPI print is still total dogshit but the market reacted they way it did because it reset expectations.

Yeah, I’m starting to get calls for a GT500, but I keep telling them I’m not paying over sticker….

Starting to see pricing drop. Seeing lightly used current gen Corvettes in the low 80's pop up.

Already have one on order. It’ll likely be a ‘24 MY.Starting to see pricing drop. Seeing lightly used current gen Corvettes in the low 80's pop up.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)