I read through their 30+ page report this morning. It's interesting stuff, nothing shocking or crazy alarming. I tried to post the pdf but it was too large, not sure how to shrink a pdf file?

Interesting exerts:

Those were the biggest hitting statements I read. Would be happy to email over the full pdf if anyone is interested; or if someone knows how to resize a pdf file.

Interesting exerts:

- "We believe the second quarter could produce the best used-vehicle sales for the year." - pg 3

- "Of all new vehicles sold in April 2020, a record 21% got zero-percent financing. Typically, zero-percent financing accounts for less than 5% of new-vehicle transactions."pg 6

- "In 2021....the average listing price- the asking price- hit a record, approaching $46,000. The average transaction price- the price paid- was even higher at more than $47,000." pg 8

- "Automakers...longer-term are re-thinking old ways. Specifically, they are looking at how they can keep prices and thus profit margins high by maintaining lower inventory." pg 8

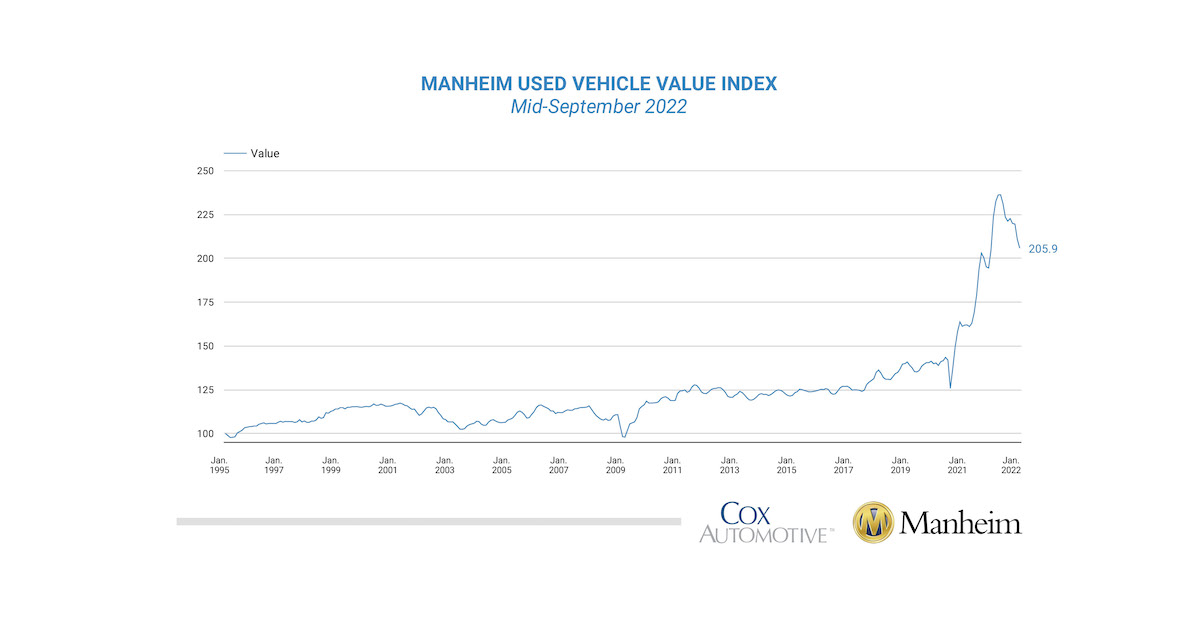

- "The average used-vehicle listing price started 2021 at $22,083 and ended at close to $28,193, nearly a 28% increase." pg 16

- "Subprime lending grows but loses share. A key measure of credit access in auto lending is the number of loans made to subprime borrowers. Auto loan originations increased in 2021 in all credit tiers, unlike the performance in 2020 when the highest credit tiers drove the growth. Subprime auto loan originations in 2021 increased by 12.1%, still less than any of the growth in the other credit tiers and as a result, the subprime share of total originations fell to an 18-year low of 16.8%. pg 18

- "Keeping a vehicle for transportation is so vital to borrowers that, even at the worst stage of the Great Recession, the default rates on auto loans remained close to 4%. In comparison, defaults rose to nearly 6% for mortgages, and over 9% for credit cards. The default rate on all auto loans in 2021 was 2.0%, down fro 2.2% in 2020 and 2.9% in 2019." pg 19

- "The average new loan payment in 2021 was $612, a 7% increase over 2020. The average used loan payment in 2021 was $480, a 15% increase over 2020." pg 21

- "Auto loan defaults, repossessions fell to at least a 16-year low." pg 25

- "Given the uncertainties mentioned earlier [supply chain, depressed factory volumes, decrease in new vehicle availability, and a significant decrease in off-lease units], we expect any future impacts to raise risk to the downside, though not to levels that would be considered a major decline or price correction." pg 29

Those were the biggest hitting statements I read. Would be happy to email over the full pdf if anyone is interested; or if someone knows how to resize a pdf file.