Kind of a flashing red light to me.

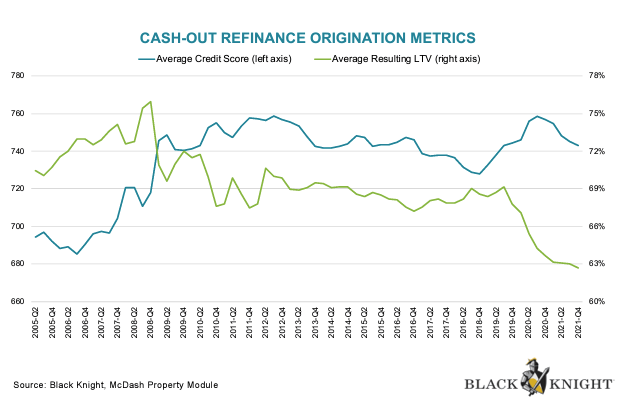

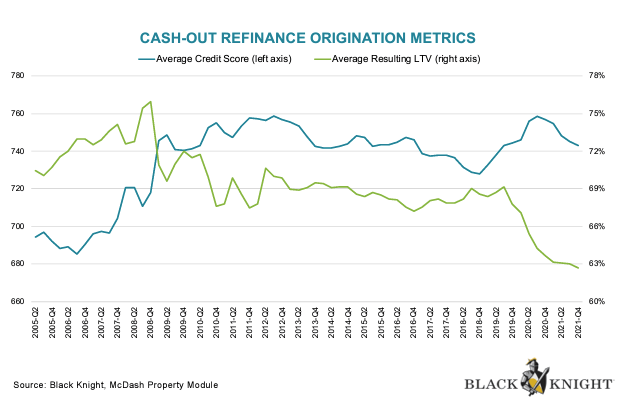

Cash-out refinancing of mortgages reached $1.2T, a 16-year high, in the U.S. last year even as overall refinance orginations fell 34%, according to Black Knight's Mortgage Monitor report.

The cash-out refi activity came within 1% of the all-time high as homeowners tapped $275B in equity over the course of 2021. And the $80B in equity tapped in Q4 2021 marked the largest quarterly volume in 15 years, as more than 1M homeowners withdrew equity through cash-out refinancing for the fifth straight quarter, Black Knight said.

Rate/term refinancing dropped a whopping 60% to $2.7T.

Total originations of $4.4T in 2021, outpaced the prior record with purchase lending of $1.7T hitting its highest point ever.

Black Knight's Optimal Blue rate lock data show that cash-out activity continued to increase in the first month of 2022.

Retention rates for cash-out refinancing remained a weak point. Mortgage servicers saw overall retention rates reach an eight-year high last year. But the cash-out retention rate was 8 percentage points lower than for rate/term refis.

On average, borrowers that changed lenders received rates just 5 basis points lower than those retained, indicating that, while rates are important, pricing isn't the only factor to keeping customers.

In January, Freddie Mac's forecast expects the housing market to "remain stable" this year even as mortgage rates rise.

Cash-out mortgage refinancing hits 16-year high, Black Knight report says

Mar. 07, 2022 10:48 AM ETCash-out refinancing of mortgages reached $1.2T, a 16-year high, in the U.S. last year even as overall refinance orginations fell 34%, according to Black Knight's Mortgage Monitor report.

The cash-out refi activity came within 1% of the all-time high as homeowners tapped $275B in equity over the course of 2021. And the $80B in equity tapped in Q4 2021 marked the largest quarterly volume in 15 years, as more than 1M homeowners withdrew equity through cash-out refinancing for the fifth straight quarter, Black Knight said.

Rate/term refinancing dropped a whopping 60% to $2.7T.

Total originations of $4.4T in 2021, outpaced the prior record with purchase lending of $1.7T hitting its highest point ever.

Black Knight's Optimal Blue rate lock data show that cash-out activity continued to increase in the first month of 2022.

Retention rates for cash-out refinancing remained a weak point. Mortgage servicers saw overall retention rates reach an eight-year high last year. But the cash-out retention rate was 8 percentage points lower than for rate/term refis.

On average, borrowers that changed lenders received rates just 5 basis points lower than those retained, indicating that, while rates are important, pricing isn't the only factor to keeping customers.

In January, Freddie Mac's forecast expects the housing market to "remain stable" this year even as mortgage rates rise.