I am about to bite the bullet on a 2013 Mustang. I already have spoken to a sales person and a test drive. During that 45 min span, we have agreed upon $100 over invoice, though i'm sure there is room for more negotiation if they really want the sale.

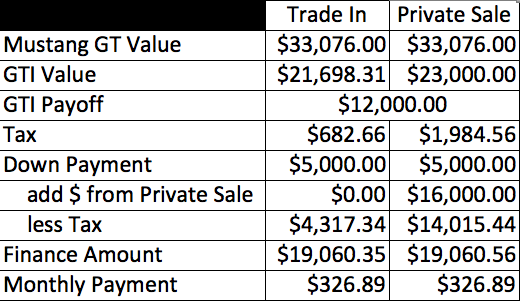

Next step is to see if I want to trade my car or private sell, and negotiation if i trade it in. I am using $23,000 as a private sell base point (just playing with numbers here, so please bear with me).

I am assuming a 2.9% apr. With a private sale, my goal monthly payment is 326.89 and used that to figure out the my "trade in" value.

Can someone confirm my table to see if I am in the ball park as to how the tax breaks work? If I don't have to go thru the hassle of private sell.

Next step is to see if I want to trade my car or private sell, and negotiation if i trade it in. I am using $23,000 as a private sell base point (just playing with numbers here, so please bear with me).

I am assuming a 2.9% apr. With a private sale, my goal monthly payment is 326.89 and used that to figure out the my "trade in" value.

Can someone confirm my table to see if I am in the ball park as to how the tax breaks work? If I don't have to go thru the hassle of private sell.