You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SVB is Now In the Hands of the FDIC

- Thread starter 2003RedfireVert

- Start date

These securities are complicated and technical. The cliff version is that they are bonds that convert to equity when banks need regulatory capital.

This weekend these were wiped out. CS equity was not wiped out and the bank will still pay bonuses.

Who the **** is going to hold a bond that is subordinate to equity? The SNB just blew this market up which will make the cost of regulatory capital even more expensive.

I have a scheme to exploit this but it is too complicated to explain on the interwebz.

www.wsj.com

www.wsj.com

This weekend these were wiped out. CS equity was not wiped out and the bank will still pay bonuses.

Who the **** is going to hold a bond that is subordinate to equity? The SNB just blew this market up which will make the cost of regulatory capital even more expensive.

I have a scheme to exploit this but it is too complicated to explain on the interwebz.

Credit Suisse Bond-Wipeout Threatens $250 Billion Market

The deal would write down more than $17 billion of the bank’s riskiest bonds.

Last edited:

These securities are complicated and technical. The cliff version is that they are bonds that convert to equity when banks need regulatory capital.

This weekend these were wiped out. CS equity was not wiped out and the bank will still pay bonuses.

Who the **** is going to hold a bond that is subordinate to equity? The SNB just blew this market up which will make the cost of regulatory capital even more expensive.

I have a scheme to exploit this but it is too complicated to explain on the interwebz.

Credit Suisse Bond-Wipeout Threatens $250 Billion Market

The deal would write down more than $17 billion of the bank’s riskiest bonds.www.wsj.com

Seems like every time a big-time failure where bonds rank in the pecking order question comes up, bondholders take it up the ass. It's like it's a set-in stone rule until it's not.

LOL. The last rescue plan is only 3 days old.

www.wsj.com

www.wsj.com

WSJ News Exclusive | JPMorgan CEO Jamie Dimon Leading Efforts to Craft New First Republic Bank Rescue Plan

JPMorgan Chase CEO Jamie Dimon is leading discussions with the chief executives of other big banks about fresh efforts to stabilize troubled First Republic Bank.

"If only we had better regulations none of this would be happening."

View attachment 1785939

Is this showing UBS as having the same level exposure at CS?

Sent from my iPhone using the svtperformance.com mobile app

Is this showing UBS as having the same level exposure at CS?

Sent from my iPhone using the svtperformance.com mobile app

UBS' capital ratio is slightly better than CS before they blew up but not enough to matter. As you can see CS was better than most other banks right before it blew up. UBS paid 7% of book value for CS (LOL).

The required capital ratios do not seem to be a good indicator of protection.

"Its not systemic"

"It not even the most significant market event in the last year"

This is what all the banks hold on their balance sheets. A chart that goes up is not good....

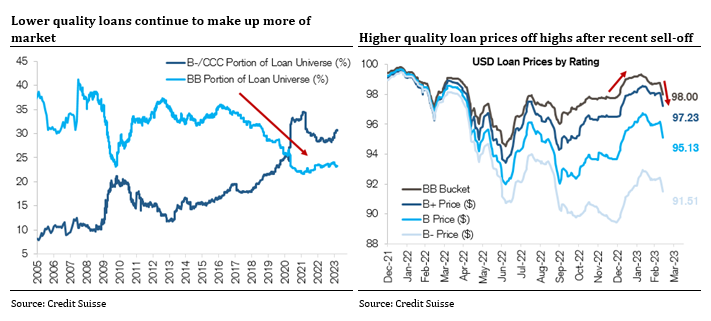

The contagion is spreading from rate markets to credit markets. This will be the next leg. Banks are shoring up their balance sheet. The result is a tightening of credit. As credit tightens, defaults will pick up as corps have difficulty refinancing.

"It not even the most significant market event in the last year"

This is what all the banks hold on their balance sheets. A chart that goes up is not good....

The contagion is spreading from rate markets to credit markets. This will be the next leg. Banks are shoring up their balance sheet. The result is a tightening of credit. As credit tightens, defaults will pick up as corps have difficulty refinancing.

When do we get finance and political people swan diving off of tall buildings or calling shotgun like Kurt Cobain?

Sent from my iPhone using svtperformance.com

Sent from my iPhone using svtperformance.com

I posted this in the stock page but it is worth some deep thoughts… when the fed makes the 1st rate cut after hitting peak, it is LIGHTS OUT for the market.

Maybe this time is different… point is bond market is pricing a full percent of cuts by EOY.

Pucker up B holes.

Maybe this time is different… point is bond market is pricing a full percent of cuts by EOY.

Pucker up B holes.

A little off topic but after all the talk about banks & where to go. I Admit I'll have been just a bit tardy in transferring funds. thinking about the FDIC limit. Is 250 K but in calling my bank they pointed me to fdic.gov And straight from this page govt I found that if you have beneficiaries (pod)it adds to the insurance amount ie from two hundred and fifty k to 500k , etc. How I would collect on that I do not know but I am still in the process of evening out funds. as I am retired. Now I worry about my 457 given this fool Bìden Does anyone have any thoughts about this logic or lack of it. As always thank you very much.

My opinion of the most significant event of the last year was the bond break from march to june 22 which put all this other crap into motion. I stand by that statement."Its not systemic"

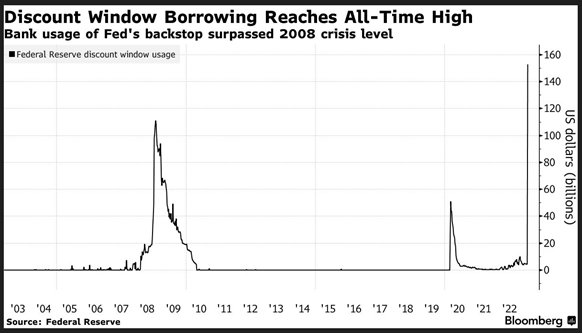

View attachment 1785974

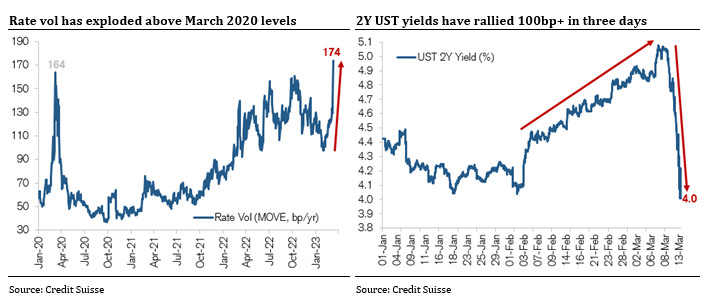

"It not even the most significant market event in the last year"

View attachment 1785975

This is what all the banks hold on their balance sheets. A chart that goes up is not good....

View attachment 1785976

The contagion is spreading from rate markets to credit markets. This will be the next leg. Banks are shoring up their balance sheet. The result is a tightening of credit. As credit tightens, defaults will pick up as corps have difficulty refinancing.

View attachment 1785977

My opinion of the most significant event of the last year was the bond break from march to june 22 which put all this other crap into motion. I stand by that statement.

The vol in rates markets right now is on par with March 2020, Sept 2008, 9/11, LTCM, Cuba missle crisis, Black Monday 1987. It is epic.

The fed bought more bonds in 3 days than they did in the previous 4 weeks. QT flipped to QE in a day.

Anyone that thinks this is no big deal knows nothing about capital markets.

This is a very big deal. It started with the bond drop from March to June 2022. It was clear to me this was coming by mid-year last year. Only question was what would set it off and would it be banks or a catastrophic insurance event.

I’m going to pull 200k out of my wife and I’s 401Ks before markets tank. Where should we put them to profit in the mean time?

A lake house or cattle as mentioned by @Rb0891

Edit: i should clarify this with an /s

A lake house or cattle as mentioned by @Rb0891

Edit: i should clarify this with an /s

If you fear a market tank why not just transfer an amount from equities into a cash equivalent within your 401k? Unless you really want to buy a hard asset of course.I’m going to pull 200k out of my wife and I’s 401Ks before markets tank. Where should we put them to profit in the mean time?

A lake house or cattle as mentioned by @Rb0891

Edit: i should clarify this with an /s

I’m going to pull 200k out of my wife and I’s 401Ks before markets tank. Where should we put them to profit in the mean time?

A lake house or cattle as mentioned by @Rb0891

Edit: i should clarify this with an /s

I have followed the advice of @DaleM and moved the entirety of my 5 figure net worth into Franklin Mint collectibles and Arbys gift cards.

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)