If the east rises then Putin did what was necessary to elevate his country. Russian Putin cares more about Russia than American Xiden / Pelosi care about America. Period.Unfortunately, we are part of the generation that will witness the rise of the east and the fall of the west (and US). In a country that makes nothing but lawyers and real estate agents, how can it continue to succeed against an engineering and manufacturing powerhouse that mimics the US circa 1945?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market Leverage

- Thread starter Weather Man

- Start date

The east is china, apparently Putin prefers the taste of chinese wang.If the east rises then Putin did what was necessary to elevate his country. Russian Putin cares more about Russia than American Xiden / Pelosi care about America. Period.

China could be West depending on which way you're looking. If you're in California you are east of China lol!The east is china, apparently Putin prefers the taste of chinese wang.

Is the Fed even ****ing paying attention?

Stock Market Leverage Spikes, Margin Debt Up 42% YoY

Nov. 19, 2021 11:25 AM

Summary

Only part of the leverage in the stock market is tracked and disclosed on a monthly basis. Much of the leverage happens in the shadows, including Securities Based Lending (SBA) that banks may or may not disclose on a quarterly or annual basis; leverage at the institutional level such as with hedge funds, an $8.5 trillion industry; and leverage associated with options and other equities-based derivatives.

- The only leverage data we do get on a monthly basis is margin debt at brokers, reported by FINRA.

- The increase in margin debt has become a huge outlier, compared to prior years, with margin debt ballooning by 42% year-over-year and by 66% in two years.

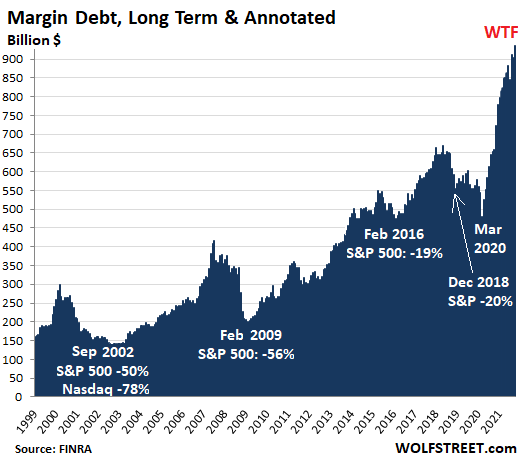

- High levels of stock market leverage are one of the preconditions for a massive sell-off. It’s hard to have a massive sell-off without a lot of leverage.

It’s only when something blows up that we can see tidbits of this leverage emerge in all its splendor, such as when Archegos imploded earlier this year.

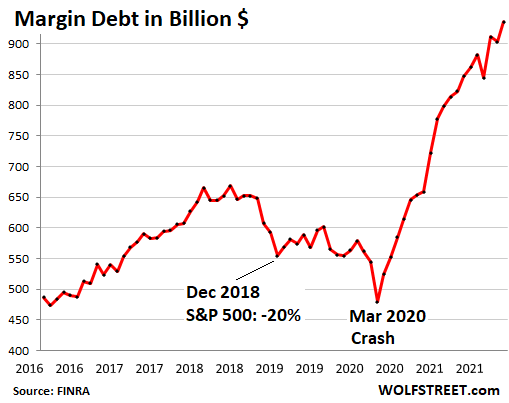

The only leverage data we do get on a monthly basis is margin debt at brokers, reported by FINRA. And we got another doozie: Stock market margin debt spiked by $33 billion in October from September to another all-time high of $936 billion, up by $277 billion, or by 42%, from a year ago, and up by 67% from October 2019.

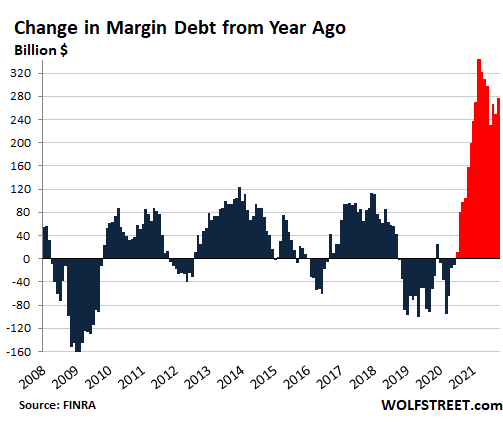

The increase in margin debt has become a huge outlier, compared to prior years, with margin debt ballooning by 42% year-over-year and by 66% in two years, summarized by this chart of year-over-year changes, with the period since March 2020 in red:

This type of stock market leverage doesn’t predict when the market will crater. What it does predict is that when this market is going down hard enough, it will trigger massive bouts of forced selling as margin calls are going out, and leveraged investors have to sell stocks to pay down their margin debt, which then pushes down prices further, which then triggers more forced selling, and more fears of forced selling, as portfolios are being liquidated, thereby accelerating the swoon.

This is why leverage is a risk to financial stability. And why the Fed keeps talking about leverage in its Financial Stability Reports.

But apparently no one at the top of the Fed – least of all Powell and the other members of the FOMC – ever reads these Financial Stability Reports because the FOMC, out of the other side of its mouth keeps encouraging ever more leverage with its interest rate repression and money printing.

Margin debt is the big accelerator on the way up, as borrowed money enters the market and creates new buying pressure.

And margin debt is the big accelerator on the way down, as this borrowed money gets drawn out of the market and vanishes by paying off debts, thereby creating selling pressure.

High levels of stock market leverage are one of the preconditions for a massive sell-off. It’s hard to have a massive sell-off without a lot of leverage.

In its Financial Stability Report, released this month, the Fed is particularly warning about high leverage among young stock market investors.

“The median leverage ratios of younger retail investors are more than double those of all investors, leaving these investors potentially more vulnerable to large swings in stock prices, as they have a larger debt service burden,” the Fed said in the report.

“Moreover, this vulnerability is amplified, as investors are now increasingly using options, which can often boost leverage and amplify losses,” it said.

High leverage is a sign of high and growing “risk appetite,” as the Fed calls it. And concerning the risk appetite of these investors, and their reliance on the social media, the report warns:

“A potentially destabilizing outcome could emerge if elevated risk appetite among retail investors retreats rapidly to more moderate levels,” the Fed said.

But what the heck.

Out of the other side of its mouth the Fed is still repressing short-term interest rates to near zero, and it’s still engaging in large-scale money printing to repress long-term interest rates and heat up further that risk appetite that it warns could retreat, and when it retreats, could produce “a potentially destabilizing outcome.” So…

Here’s the long-term view of margin debt. Given that the purchasing power of the dollar has dropped over the period, it’s not the long-term increases in absolute dollar amounts that matter, but the steep increases in margin debt before the selloffs, and the magnificent increase underway now:

Original Post

$ amounts of margin debt tell you nothing about market health. Also, it is not within the mandate of the Fed Reserve to control markets (thank god).

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)