- Joined

- Jul 14, 2002

- Messages

- 9,444

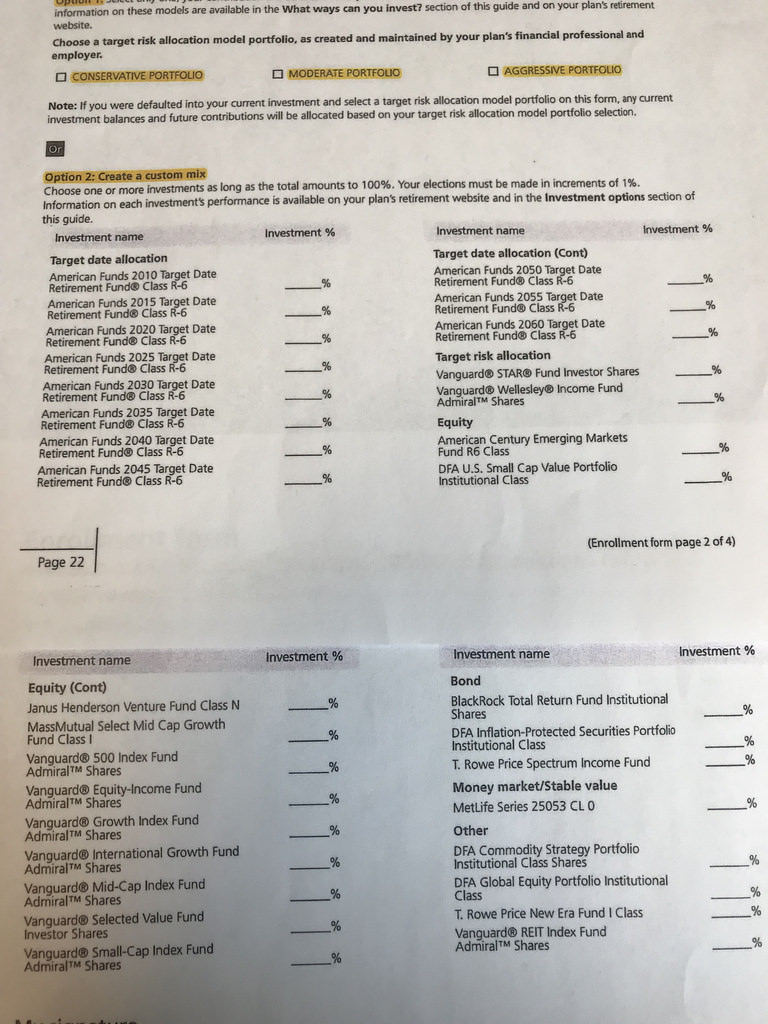

I'll be honest, I've never been much in place of saving in my life before. This hobby was a huge reason for it in the past to be honest. Anyways I'm now I guess planted in my career and plan on staying at my company for a good while. With that being said my company pretax takes out 4% and also matches the 4%. That comes out to about $400 a month going into my 401k. Problem is I do not know anything about 401k or what to invest in. I've talked to a couple of very successful managers here and they all told me the same thing, since I'm in my 30's I should be aggressive. Below is the investments I can choose from within my company and we use Vanguard. One of the CEO's told me to focus on technology and petrols.

What advice do you guys have for me? I'm starting from scratch here in both knowledge and money.

What advice do you guys have for me? I'm starting from scratch here in both knowledge and money.