I would really like to start focusing on building my credit score stronger, I understand it takes several years and good spending habits as well as on time monthly payments, But what is the absolute best way to USE a credit card to help build that credit score up? And out of Capital One, Discover, Or Chase, Would be the best company to go with? I have no negative actions on my credit report through all 3 bureaus so im good there. I hear a good way to build credit, Is to STOP using Debit, and run everything through my credit card, and pay it off to a zero balance every month?? is that also true? lets hear it all

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Advice with credit cards, and which ones?

- Thread starter 4stang6

- Start date

One of the best ways to improve you're score is to use a credit card and pay it off every month. Yes. I don't think the brand matters. Loans help too but only after you pay them off. The more you use and pay off the better your score goes.

Last edited:

there are a lot of ways to go about it.

1) which brand doesn't matter. I would go on somewhere like nerd wallet and look at whats out there. Do you want to earn some cash back, travel points etc... some cards have sign up bonuses and such. I think they may give you a guide on what kind of score you need to qualify.

2) watch out for cards with annual fees, just be aware of them and what you get for what you pay

3) be honest about your self discipline - can you put everything on your card and pay it off every month or will you end up in debt?

3b) if not, put some of your monthly subscription stuff on there, put it on autopay and lock the card away

I see some people saying to carry a balance, I have NEVER done that. Keep your credit utilization low - like under 10% or they start dinging you it seems

if you've been paying utilities and such in your name I believe thats what the Experian boost thing does - it looks at those things and adds them in.

I had some year end bills hit at the same time along with spending while on a trip, used ~15% of my available credit and the fools knocked me down 40 points which is insane imho but it'll recover in a month or two. I put EVERYTHING on my CCs but I pay them off every month. Following the above got me over the 750 mark pretty quickly, seems like you qualify well after that and now usually in the low 800 range. I don't care to play the game any further, I dont see a need

1) which brand doesn't matter. I would go on somewhere like nerd wallet and look at whats out there. Do you want to earn some cash back, travel points etc... some cards have sign up bonuses and such. I think they may give you a guide on what kind of score you need to qualify.

2) watch out for cards with annual fees, just be aware of them and what you get for what you pay

3) be honest about your self discipline - can you put everything on your card and pay it off every month or will you end up in debt?

3b) if not, put some of your monthly subscription stuff on there, put it on autopay and lock the card away

I see some people saying to carry a balance, I have NEVER done that. Keep your credit utilization low - like under 10% or they start dinging you it seems

if you've been paying utilities and such in your name I believe thats what the Experian boost thing does - it looks at those things and adds them in.

I had some year end bills hit at the same time along with spending while on a trip, used ~15% of my available credit and the fools knocked me down 40 points which is insane imho but it'll recover in a month or two. I put EVERYTHING on my CCs but I pay them off every month. Following the above got me over the 750 mark pretty quickly, seems like you qualify well after that and now usually in the low 800 range. I don't care to play the game any further, I dont see a need

Well, glad you started this thread. That score drop was bothering the hell out of me… after checking credit karma called the CC company and turns out my ex never did take me off one of her cards and she damned near maxed it out which is what tanked me

I’m a 820 and my wife is a 840. Go figure, I make a ton more than her. Was never that way years ago. Zero debt, and bills are paid monthly. I use my cards a bunch.

I built my credit score with 0% interest cards. I started with a Summit Racing card. I would order parts I wanted that I already had the cash for. Then I got a Costco Citi Visa, 0% into with cash back to boot. I used that for all my fuel purchases since Costco was a convenient fill up and I would maximize cash back. I cancelled the Citi card after they went woke and started up their anti 2A BS. When one 0% interest card would lose its intro rate I'd apply for another one and keep the 0% rolling. Got my credit up to high 700s without carrying more than $2-3k balance at one time. That allowed me to take advantage of the ultra low interest rates for a home loan and now I just have to maintain my score.

A wide variety of credit like cc, personal loans, a car loan, with exceptional payment history really help your credit worthiness. Lenders typically like to see that you’re responsible with your finances.

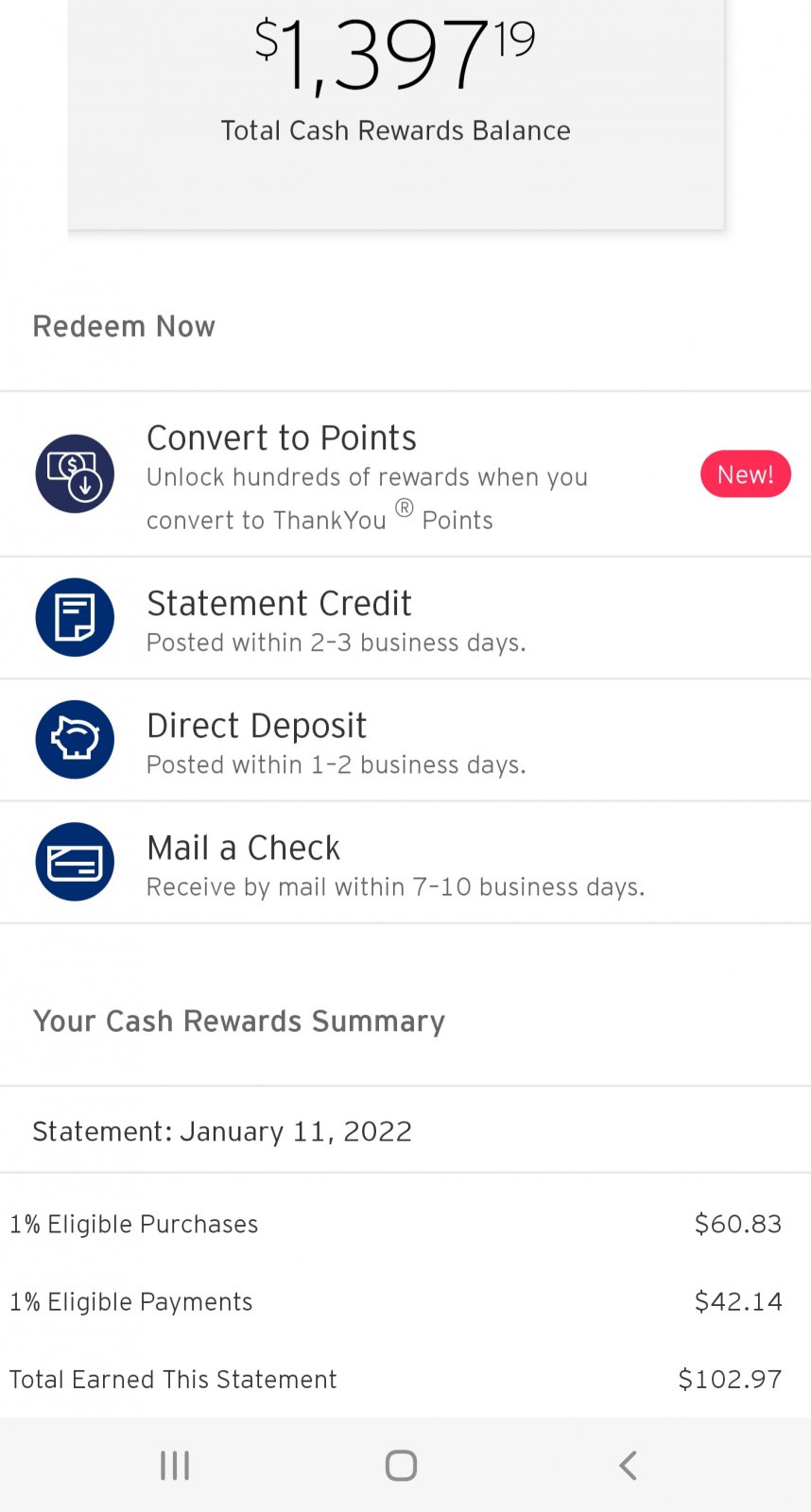

On the recommendation of another SVTP member, I applied for Citi Card which has a 2 Points cash back rewards program, no annual fee.

1 point awarded for purchase.

1 point awarded for paying the purchase off

We charge everything to it except for things like loan payments that cant be paid via credit card.

We pay it off every month. Its easier to track our spending too. After 6 months, we accumulated $335.00 cash back. Thats car parts or a free AirBnb for Mustang Week

Sidenote, PROPERTY, like a house mortage helps build credit. Was so exited to sell my house after 15 years. My credit score fricken dropped

Lots of paid off car loans help too

1 point awarded for purchase.

1 point awarded for paying the purchase off

We charge everything to it except for things like loan payments that cant be paid via credit card.

We pay it off every month. Its easier to track our spending too. After 6 months, we accumulated $335.00 cash back. Thats car parts or a free AirBnb for Mustang Week

Sidenote, PROPERTY, like a house mortage helps build credit. Was so exited to sell my house after 15 years. My credit score fricken dropped

Lots of paid off car loans help too

Last edited:

Here's an example. I couldn't add it to my original post

Last edited:

I've had my chase card for a good 15 years with absolutely no complaints. I charge everything to it and pay it off completely every month. There has been an exception or two with large purchases but always the following month.

I started with a $500 balance due to no income (college student) but it goes up with wages. It's easy to overspend especially with online shopping these days.

The whole points thing is way beyond me. It might be worth checking into if you spend serious money. I get points and I use them on Amazon gift cards when I get enough.

I started with a $500 balance due to no income (college student) but it goes up with wages. It's easy to overspend especially with online shopping these days.

The whole points thing is way beyond me. It might be worth checking into if you spend serious money. I get points and I use them on Amazon gift cards when I get enough.

My credit has been all over the place the past 2 years. From 830 down to 720 back up to 793 right now. I pay off the balance every month. Length of loans is huge. The longer you’ve been paying on a loan the better your credit gets. The second I paid off the 30k balance on my truck my credit dropped over 50 points.

Same happened to me but it came back up to where it was over a few months.. makes no senseMy credit has been all over the place the past 2 years. From 830 down to 720 back up to 793 right now. I pay off the balance every month. Length of loans is huge. The longer you’ve been paying on a loan the better your credit gets. The second I paid off the 30k balance on my truck my credit dropped over 50 points.

Lots of good info in here.

Cards with good rewards like air miles or hotel points will have an annual fee.

If that’s no biggy to you because you won’t use them, just get a free card.

Go into settings and have it pay the balance in full monthly.

You can request a credit line increase online once you’ve been open for awhile. This also helps your credit score since you have more borrowing power.

Don’t ever pay 1c in interest. Use it like a debit card.

If you get in a jam, zero percent balance transfers work. Did it when I was just out of high school and on my own.

Sent from my iPhone using svtperformance.com

Cards with good rewards like air miles or hotel points will have an annual fee.

If that’s no biggy to you because you won’t use them, just get a free card.

Go into settings and have it pay the balance in full monthly.

You can request a credit line increase online once you’ve been open for awhile. This also helps your credit score since you have more borrowing power.

Don’t ever pay 1c in interest. Use it like a debit card.

If you get in a jam, zero percent balance transfers work. Did it when I was just out of high school and on my own.

Sent from my iPhone using svtperformance.com

Like many have said, just use it like a debit card. Can’t tell you the last time we used debit outside of an ATM.

Home and car loans are easy to build it.

Find a card with decent rewards. I carry loans to term because interest rates are so cheap. Investments outperform the % rate on the loans so we’re coming out ahead.

We’ve had good luck with capital one.

Home and car loans are easy to build it.

Find a card with decent rewards. I carry loans to term because interest rates are so cheap. Investments outperform the % rate on the loans so we’re coming out ahead.

We’ve had good luck with capital one.

I don't carry any balance on my cards month to month, but I do allow my statement to cut before paying. If you don't, it'll look like you never use the card and it won't help your credit much at all.

I use two cards a lot.

Discover card that has quarterly perks such as 5% off Paypal for 3 months, or 5% groceries, and 5% off Walmart/Amazon/Target online for 3 months etc..

Amex Preferred. Has a 95 dollar fee but with 6% back on groceries and streaming, 3 % on gas etc... The fee is well worth it to me.

And their sign up bonus now is $350 "cash back" if you spend 3k in 3 months. Basically pays for 4 years of the fee and there is no intro year fee.

Discover card that has quarterly perks such as 5% off Paypal for 3 months, or 5% groceries, and 5% off Walmart/Amazon/Target online for 3 months etc..

Amex Preferred. Has a 95 dollar fee but with 6% back on groceries and streaming, 3 % on gas etc... The fee is well worth it to me.

And their sign up bonus now is $350 "cash back" if you spend 3k in 3 months. Basically pays for 4 years of the fee and there is no intro year fee.

I keep my number of credit cards low. One for business and three for personal use. I pay ALL balance each month. I haven't carried a balance in about 20 years. My primary credit card is for BJs Wholesale and I used the cash back to pay for purchases at BJs. My other two personal cards are used sporadically.

I pay all of our bills on time. A late payment is unheard of for me. Those days are long gone.

As already mentioned, search for the best credit card deals (like through Credit Karma) and avoid annual fee cards unless there is a compelling feature you must have. Cash backs are common now; just compare them to see which one works best for you.

I pay all of our bills on time. A late payment is unheard of for me. Those days are long gone.

As already mentioned, search for the best credit card deals (like through Credit Karma) and avoid annual fee cards unless there is a compelling feature you must have. Cash backs are common now; just compare them to see which one works best for you.

I would really like to start focusing on building my credit score stronger, I understand it takes several years and good spending habits as well as on time monthly payments, But what is the absolute best way to USE a credit card to help build that credit score up? And out of Capital One, Discover, Or Chase, Would be the best company to go with? I have no negative actions on my credit report through all 3 bureaus so im good there. I hear a good way to build credit, Is to STOP using Debit, and run everything through my credit card, and pay it off to a zero balance every month?? is that also true? lets hear it all

4stang6, well depending on where you get your score from, it may change depending on the bureau or where you source it from. The score number is used by analyzing a bureau's credit report of you, and each bureau may or may not have a different credit report of you. They generate the credit score number from a bureau's credit report by a scoring model (essentially an algorithm). And there are over 30 different scoring models.

The reason I say this in response to your question is... when you monitor your score, make sure you pull it from the same source, because pulling it from different places could give you different scores. Whether they pull it from a different bureau, use a different scoring model, etc. Most places use FICO 8 as the main scoring model. There are others, like FICO 10 (the latest), VantageScore, or even FICO 2 (which a lot lenders use as the model to give you a score when you apply for a mortage).

SO IT ALL CAN BE DIFFERENT!

Main recommendations are:

- Always pay your monthly balances on time

- Obtain copies of your credit reports from different bureaus and monitor for any discrepancies or debts you didn't pay, collections, etc.

- Avoid using more than 50% of a card's limit. Some scoring models use "over utilization" of a card as a score modifier (essentially can lower score depending on scoring model)

- Avoid credit inquires --- Avoid hard hits on your credit. Don't finance a car, then try to finance a boat later, or a trailer etc...

- When buying a home (or other), don't shy away from get quotes from other lenders. Additional inquires after the first one, will count as "inquiries" still, but won't hurt your score anymore than the first one did, for 14 days.

- Avoid closing your oldest credit line/account (good example is your first credit card). Many lenders look to see what the oldest/longest active credit account is. I still have my very first credit card active and plan to keep it active because it is my oldest account. --- if that makes sense.

The downside to not carrying " some " debt,.............credit score goes down.

I went from 827 to 817, while using all ( 12 ) cards over the holidays.

No mortgage also doesn't help..

.

I went from 827 to 817, while using all ( 12 ) cards over the holidays.

No mortgage also doesn't help..

.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)