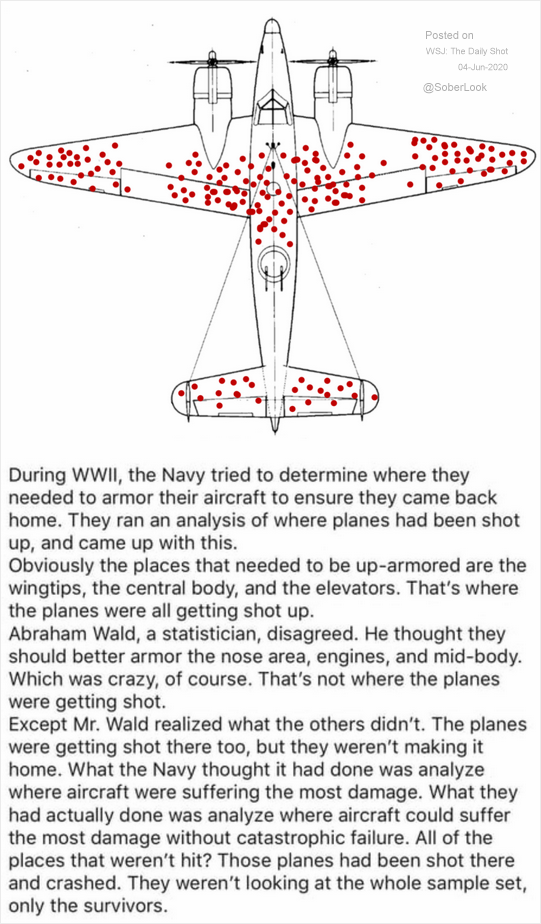

Survivalship bias is something I deal with on a day to day basis. When I am analyzing a dataset (in my case investments) I have to keep in mind that it does not include those that have flunked out. Not doing so can cause huge gaps in understanding of the sample relative to the population. This illustrates it perfectly, thought others would find it interesting.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Profile in survivalship bias

- Thread starter Klaus

- Start date

And there you have it !!

That was a great and interesting read!

Another profile in survivorship from my daily life. Thought I would connect the dots between hedge funds and bomber flights....

"Five years ago, Beer found 445 equity long-short hedge funds with $100 million in HFR’s database; only 225 remained five years later. Beer said that the data clearly reflects survivorship bias. “The survivors generally have outperformed the dead by 400-600 bps per annum,” Beer wrote in the analysis. “Funds generally stop reporting to the database due to poor performance. Therefore, due to survivorship bias, we believe the drawdown figure is understated.”

The Existential Crisis Facing Long-Short Equity

"Five years ago, Beer found 445 equity long-short hedge funds with $100 million in HFR’s database; only 225 remained five years later. Beer said that the data clearly reflects survivorship bias. “The survivors generally have outperformed the dead by 400-600 bps per annum,” Beer wrote in the analysis. “Funds generally stop reporting to the database due to poor performance. Therefore, due to survivorship bias, we believe the drawdown figure is understated.”

The Existential Crisis Facing Long-Short Equity

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)